Online Video CPE Courses

- ACA Overview & Key Terms

- ACA Individual Tax Implications

- ACA Business Tax Implications

The Affordable Care Act (ACA) is changing the tax industry. We have created a 4-step solution to help guide you through these changes and establish your business as the Healthcare TaxPro of your community.

Online Cloud-Based Video CPE Courses

Online Cloud-Based Video CPE CoursesNARTRP offers 4 hours of ACA classes covering everything from the basic terminology to the more complicated points of the individual and business mandate. Our cloud-based video CPE makes learning a new subject easy.

ACA Desk Manual with Instructional Video

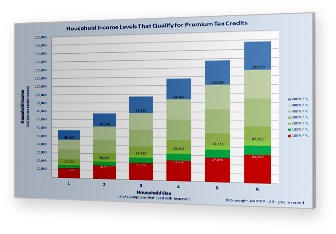

ACA Desk Manual with Instructional VideoWe've taken the most important information from the ACA courses and condensed it down to 4 pages of charts and graphs. This desk manual will help you identify which of your clients qualify for premium tax credits and how the Affordable Care Act will effect them. This is a very important tool and we recommend having one at each tax preparation desk.

Health Insurance Partnership

Health Insurance PartnershipWe've partnered with Marketplace America so our members have access to a healthcare specialist for you and your uninsured clients. Use the No-Coverage Penalty Calculator to quickly estimate the tax penalty for not having health insurance. Offering a health insurance solution to your clients will be a valuable service during this tax season. The more value you offer, the more a client comes to depend on you. NARTRP has the healthcare solution for your clients.

Earn Referral Revenue by Offering a Tele-Medicine Solution

Earn Referral Revenue by Offering a Tele-Medicine Solution

NARTRP has partnered with Consult-A-Doctor Plus so you can earn revenue by offering your clients a tele-medicine solution. With 50 million newly insured individuals and the same amount of doctors, tele-medicine can provide your clients a convenient way to service their basic healthcare needs. Your clients can have 24/7 access, via telephone or internet, to licensed physicians that can diagnose common medical conditions and prescribe medication.

Earn $42 for each client you refer to Consult-A-Doctor Plus.